-

Bsplindia.com

Bsplindia.com

- The neuro-behavioral

science trading edge

-

-

-

-

-

- Are you trading too

hard???

-

- Vijay L Bhambwani

Sept 12,

2016

-

-

Coming from a business family has its advantages. I had the opportunity

to learn about success traits at an early age, from successful

businessmen who had actually achieved what others aspired to achieve.

The one thing that I heard repeatedly is that if a deal is too laborious

to chase and conclude, and if the returns are expected to be average, it

is better to give it a pass. Ancient wisdom has advocated - fatigue

makes a coward of the bravest soldier in battle. So conserving energy is

important, more important is efficient allocation of energy. Your

efforts should yield maximum profits in the least amount of time and

with controlled risk parameters. In the jungle, a lion has to outrun the

slowest deer from the herd to be able to feed on it. Its not interested

in outrunning the fastest deer. Its not even needed to. In short, choose

the low hanging fruits, the "easy" trades, ride them well and let your

profits run, but only to the point where the trajectory & velocity of

the present trade is better than alternate trades available. At the same

time, any trading system you program, must be able to quantify that

metric.

-

-

Enter the trade efficiency ratio (TER). Its a tool a savvy trader uses

to gauge how much effort + costs he / she puts in to earn a Rupee in

profits, after all execution costs & taxes put together. You then take a

ratio of net profits versus the costs incurred. (the formula for MS

Excel lovers = profit after costs / all execution costs = TER). In

short, you are endeavoring to gauge how much profit you take home after

yielding money to the brokers, trading exchanges and the government. As

a capitalist, you should try to raise your share of the take home

profits and curtail the share of the others (brokers, exchanges &

govt.). The higher the trade efficiency ratio, the better for you. For,

we all get hit by a sucker trade once in a while and that's where the sh*t

hits the fan. We get emotional, make mistakes, get into a lean phase and

surrender profits to the market forces. A trader with a high TER is

better placed to tide over a bad patch. Imagine if you take meager pot

shots at the markets (low TER), even with a high success rate, one or

two sucker trades take away almost your entire months earnings. How many

times we feel this way - "its so difficult to trade for a living. I take

weeks to make X amount, invariably to give it back in 2 losing trades."

Many traders even experience the situation where execution costs were

paid out of pocket, or were a majority component of that months drag on

the profit & loss account. I have felt this way plenty of times. Then

your mind gets into the voyeurism mode - if only the STT / service tax /

exchange levies / stamp duties rates were lower, I would have still

turned out a small profit. If only algos were not so active, my

performance would have been better. But a deeper investigative analysis

pointed the needle of blame at me !!! I was pulling the plug too early,

too fast on winning trades and multiplying my efforts to keep finding

new trades and seek alpha. When the inevitable loss making sucker punch

of a trade hit me, I was exhausted from all that over trading and

reacted late / too late and the chasm of losses would widen. 1 - 2

losing trades were knocking clean a fortnight of profits. I have made

that mistake umpteen number of times in the past, and am guilty as

charged !!!

-

-

The strategy was changed thereafter. Any trade that promised a TER of

less than 2 at the outset was was a no-no. Of course, things can

go wrong, and they will, and you may have to "kill a trade" earlier on

sudden developments, but the rule of the thumb stays. I'm not interested

in trades < 2 TER. Believe me, there will be variations. Inspite of this

so called rule, the market forces have ensured that I went from 8.5 TER

to (-) 2 TER on my trades. But the net result was >2 TER. You need to

aim for the sky to be able to climb a mountain. That gave me ample

cushions to weather any losing trade/s for that month and also cut out

many trades that I would have taken hitherto in a desperate search for

absolute alpha. I cut out fatigue and frothy efforts to earn pennies at

the risk of dollars. We also revisited brokerage slabs with our brokers

and anyone not giving deeply discounted rates no more gets our business.

Costs have to be down by the trader. Because profits are dependent on

the markets forces and not on the traders aspirations. So atleast one

aspect of the cost - profit equation is under your control.

-

-

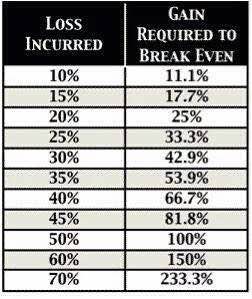

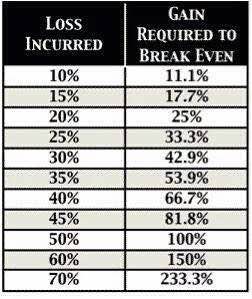

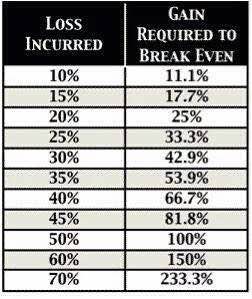

Take a look at the herculean task a trader sets out for himself after he

loses money. The graphic itself is borrowed from the timeline of a FB

contact. While the figures are daunting, they are not entirely as

honestly fearsome the real life situation is. Allow for the execution

costs, psychological pressure-to-perform and the mounting odds against

the trader and you see what you need to do first foremost and always -

focus on not losing money or you will be chopping your limbs off in the

market place. Profits are always a secondary objective. While it may

sound odd to most traders, that is exactly what professional traders do.

And when they do, they go for the chunky, meatier trades. When visiting

McDonalds, would you rather eat the burger or only the ketchup? Its self

evident really, high TER trades are the way to go forward.

-

-

-

-

This is one step amongst many towards trading smarter rather than

trading harder. I would rather leave the trading harder part to the

other guy out there. Give me my >2 TER trades, or none at all.

Bsplindia.com

Bsplindia.com

Bsplindia.com

Bsplindia.com