Bsplindia.com

Bsplindia.com Bsplindia.com

Bsplindia.comIn the 1930s, a US newspaper carried an advertisement that went like this - there would a readers survey wherein pictures of a few pretty girls would be featured daily, for a week (a few dozen girls in all). The reader just had to choose the prettiest girl in his opinion. The girl with the maximum votes would be adjudged the winner. The lucky reader who had voted for the winning girl would be chosen by a draw of lots. The prize money was US$ in cash but the winner would have to spend time in a behavioural science lab, talking to scientists about how / why he chose the winning candidate.

Luckily for mankind and behavioural finance alike, the winner was a very articulate and expressive person who helped propel forward behavioral scientists' understanding of the human brain while taking financial decisions by a few decades. This was his gameplan -

1) I was participating in this survey for the prize money. I was clear from the start about my objective

2) I knew my singular opinion did not matter in determining the final outcome (prettiest face vote winner). I was just a part of the crowd

3) Rather than merely stating my opinion, i decided to estimate what an average reader taking part in the survey would think, and vote for. I decided to vote for who I thought would get maximum votes from other readers everyday

4) For me, reading the mind of the competition was more important than merely laying down my opinion in the survey. Ultimately, there was one variable which was never in my control - even if I was with the majority who chose the winning girl, I had no way of knowing if my entry would be chosen in the draw of lots. So I had to depend on luck

What does it teach us traders?

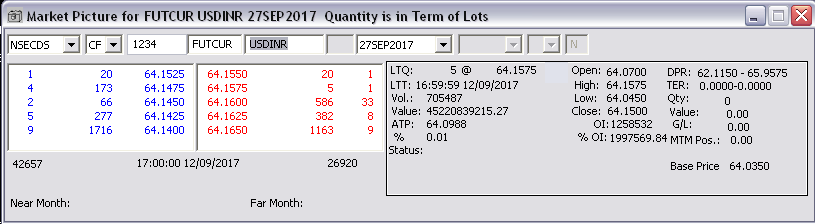

First and foremost - our individual preference hardly matters. The markets will go where the majority of the traders take it. Read the minds of the majority and you have won three-fourths of the battle. In the present day mechanised, digitised markets, there is no human intervention. You don't know who is at the other end of your computer screen, acting as your counter party. But, in these digital markets, each and every transaction is logged and factored into the last traded price (LTP), and if you watch the trading terminal screen intelligently enough, these numbers begin to "talk" to you. The modern online trader has many tools to aid his decision making process - snap quote windows, the VWAP and real-time charting tools. If you understand the numerical language that the market speaks in, you have an undeniable edge over the other traders. Then it becomes a matter of financial risk management, trade bet size optimisation and nursing the trade after getting an order "filled".

The snap quote window itself holds atleast half dozen parameters that a professional day trader would use to navigate in and out of the markets when the tide turns in his favour. Identify these signals, train your mind to understand this language of numbers and stay ahead of the game. The markets are a moving goal post, so they are not as easy to trade as people think, but some sharp thinking can raise the odds of success in your favour

But do remember - in line with the above Washington Post survey, luck will also play a part. Have a profitable day !

Vijay L Bhambwani